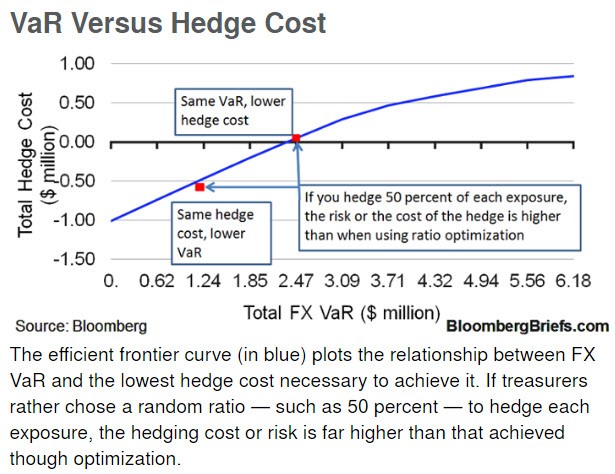

Hedge ratio optimization helps keep FX risks and costs low | Insights | Bloomberg Professional Services

How to optimize volatility trading and delta-hedging strategies under the discrete hedging with transaction costs | Artur Sepp Blog on Quantitative Investment Strategies

![Hedge Accounting [Part 2]: Prospective Testing and the Risk Induced Fair Value — Finbridge GmbH & Co KG Hedge Accounting [Part 2]: Prospective Testing and the Risk Induced Fair Value — Finbridge GmbH & Co KG](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1592261743197-7A12FCF8CQG67G9O5FPG/Abbildung+5.png)

.png)