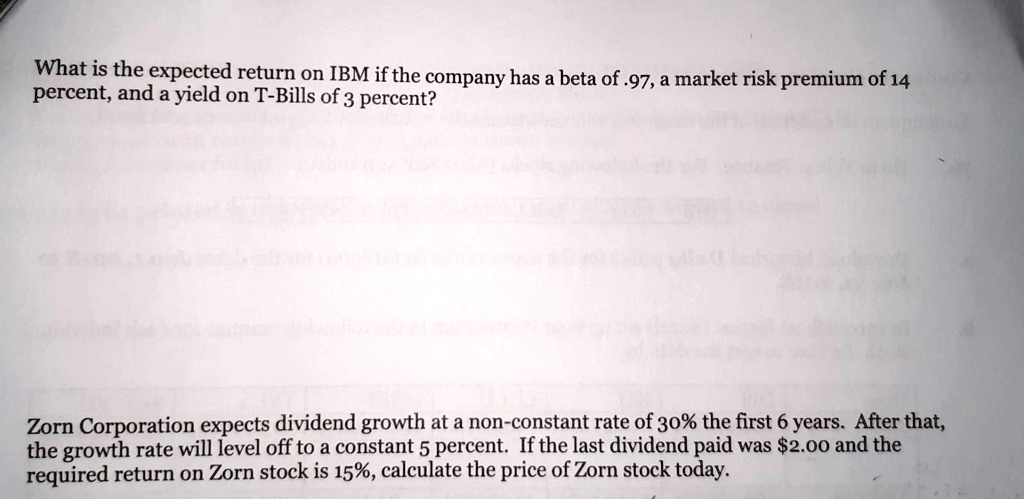

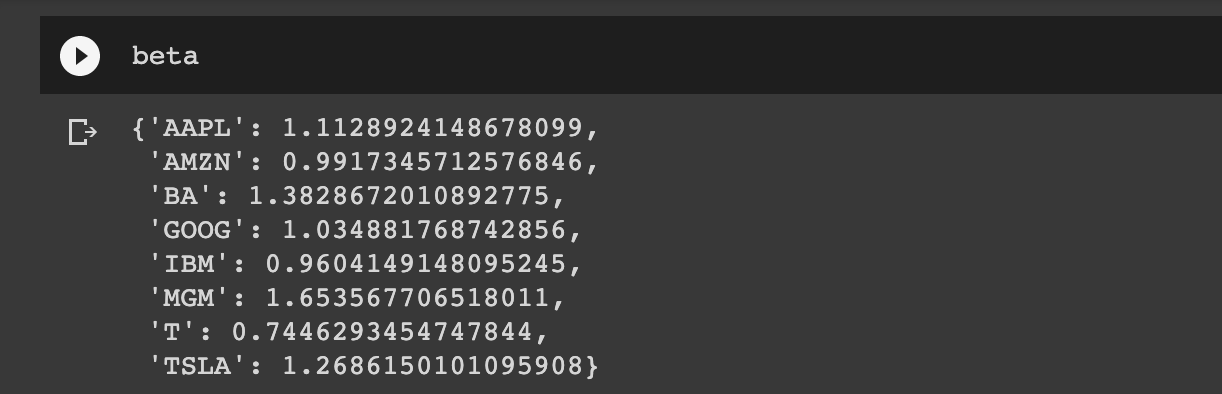

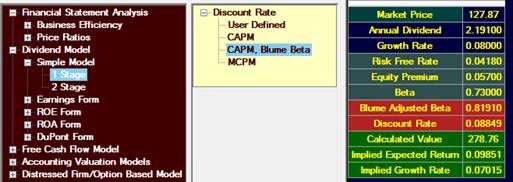

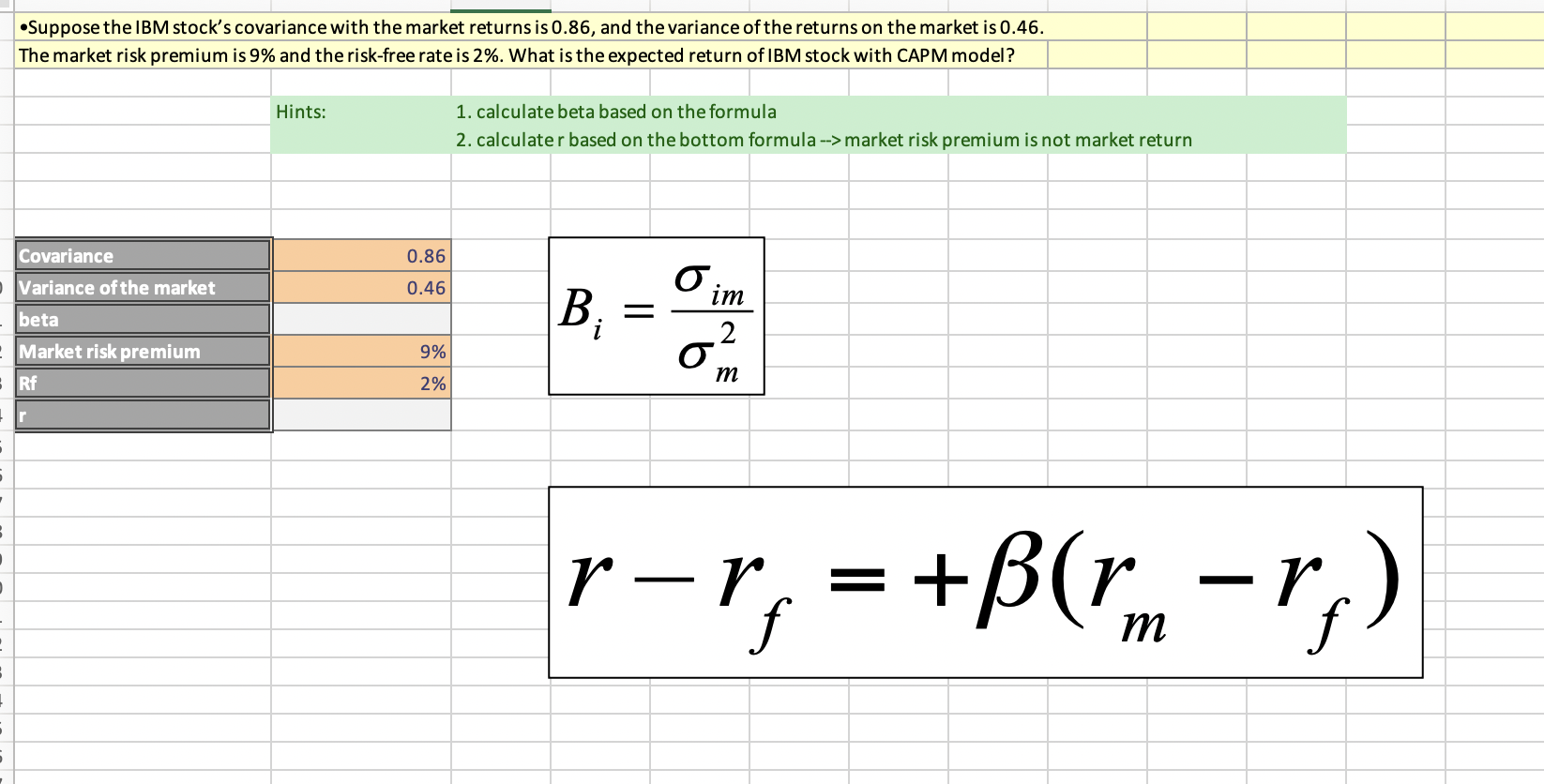

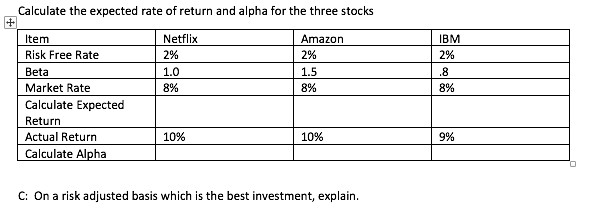

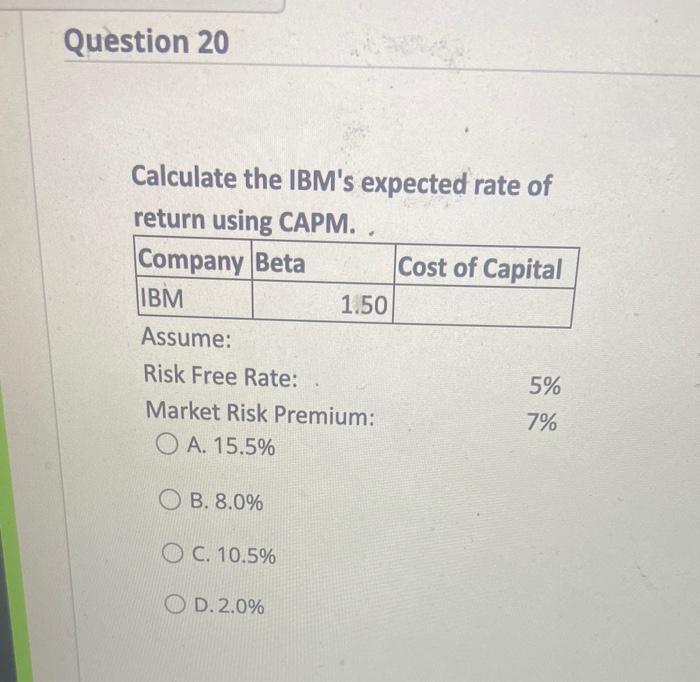

SOLVED: hoose Check for Updates 1.Find the beta for the following stocksIBM.AppleWalMart Microsoft.and Dell. 2.I am looking at a stock whose price is 45.00.Iwant a return of at least 8% and I

The quadrupole deformation parameter β IBM was calculated from SU(3)... | Download Scientific Diagram

![Solved] Suppose that the Treasury bill rate is 9% | SolutionInn Solved] Suppose that the Treasury bill rate is 9% | SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/03/603f7df28ecff_1614773745250.jpg)

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)